Pressure on natural resources in Latin America and the Caribbean: a statistical approach

Work area(s)

The nominal series of commodity exports and total exports, which form part of the recent update of information in CEPALSTAT and are available for consultation, show the pressures on natural resources in Latin America and the Caribbean.

The nominal series of commodity exports and total exports, which form part of the recent update of information in CEPALSTAT and are available for consultation, show the pressures on natural resources in Latin America and the Caribbean.

This information has been adjusted in two ways: first, the annual nominal items have been deflated to eliminate the effect of price changes; second, they have been reclassified by the natural resource from which they are derived in order to distinguish between renewables and non-renewables.

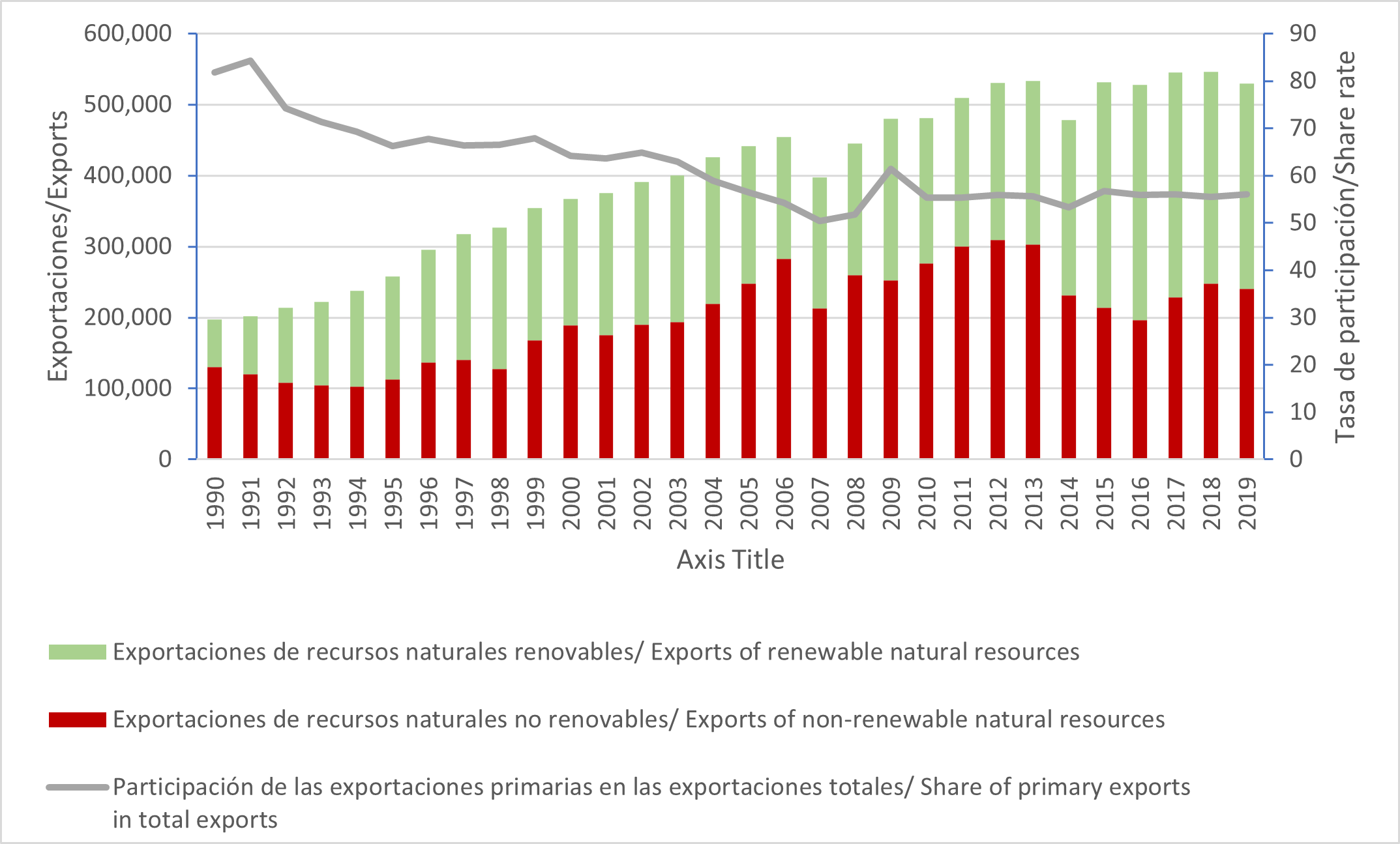

To eliminate the effect of price variations, the basic price index (44 products) was used to deflate commodities exports and the unit value index was used to deflate total exports. Thus, the proportion of primary exports in total exports was obtained for Latin America and the Caribbean for the period 1990–2019 (shown by the grey line in the graph).

Source: ECLAC, on the basis of United Nations International Trade Statistics Database (UN COMTRADE).

Source: ECLAC, on the basis of United Nations International Trade Statistics Database (UN COMTRADE).

The reclassification by natural resource of origin was done using deflated primary export data distributed by rates calculated from the reclassification of SITC five-digit headings, reclassified as primary products and semi-processed natural resources by origin (land, water, plant or animal). This yielded the share of primary exports based on both renewable and non-renewable natural resources. The bars in the graph show total primary exports at constant prices and their composition by natural resource of origin for the region from 1990 to 2019.

According to these data, which envisage systematic GDP growth for that period (pre-pandemic), the real increase seen in exports is accompanied by an expansion in primary exports. Between 1990 and 2019, real exports rise from about US$ 198 billion to US$ 530 billion (at constant 2010 prices), although primary exports maintained a share of about 58% for most of the last decade.

Permanent pressure on natural resources

Income from exports of primary natural resources in the region has been growing since 1990, thus the pressure on natural resources has also been increasing. The cumulative effects —the sum of annual flows— imply that extraction, collection and processing of natural resources put systematic pressure on the region's stock.

However, at the level of Latin America and the Caribbean as a region, the annual pressure (flow) shows certain trends. Between 1990 and 2007, the annual share of primary exports in total exports fell steeply, from just over 80% to 50%. It spiked briefly in 2009 at over 60%, but between 2008 and 2019 stabilized around 50%–60%, oscillating around 55%. So, although this annual share fell steadily and substantially between 1990 and 2007, the pattern of the region's international trade over the last three decades, with a systematic year-by-year expansion in primary exports, has undoubtedly kept up permanent pressure on natural resource stocks.

Although the pressure is permanent, the stocks of natural resources do not all decrease in the same way. The graph shows real exports divided into renewable and non-renewable natural resources. Between 1994 and 2013, exports clearly grew systematically, with the largest share coming from non-renewable natural resources, thus generating equally systematic pressure on their stocks.

Even though real exports based on non-renewables decrease in the following years, the trend continues; accordingly, there is no easing of the pressure on stocks. Even so, the data show exports from renewable natural resources growing strongly in the years after 2013, contributing practically 50% in the statistics.

It should be recalled that, although all natural resource stocks are subject to the same extraction pressure, the stocks of non-renewable natural resources, by their nature, always decrease. By contrast, the stocks of renewable natural resources will depend on whether extraction pressure is sensitive to the renewal process. The foregoing considerations are of course without taking into account the effects of differentiated regulation policies and their impacts by resource and by country.