Issuance of Sustainability-linked Bonds by Latin American Companies in International Markets Grows Exponentially in 2021

Work area(s)

The region’s top three SLB issuers were Brazil (60%), Mexico (28%) and Chile (8%), and the top three sectors transportation (26%), forestry and paper (23%) and food and beverage (22%).

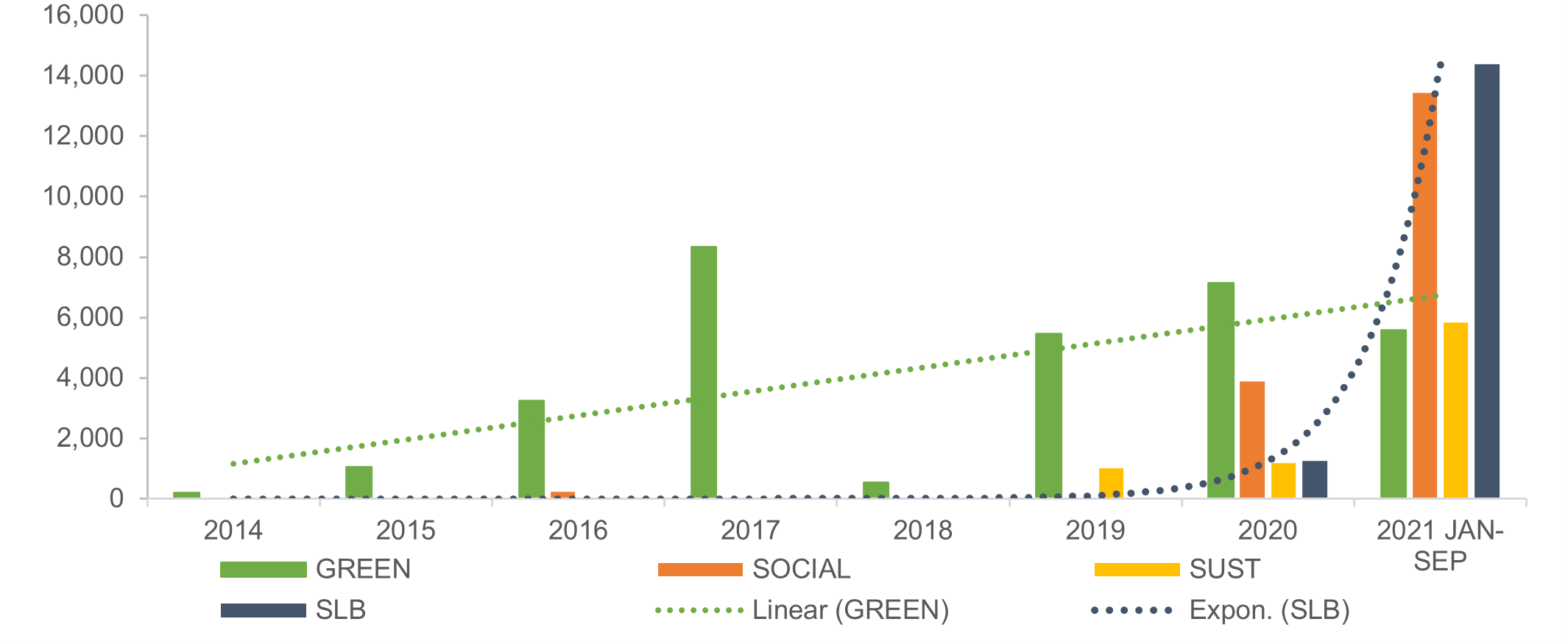

The use of environmental, social and governance (ESG) instruments by debt issuers from Latin America and the Caribbean (LAC) in international markets has grown very rapidly in the last two years. In particular, in 2021 there was an exponential growth in the international issuance of sustainability-linked bonds (SLB) by companies in the region, according to a new Economic Commission for Latin America and the Caribbean (ECLAC) report published by the Commission’s Office in Washington DC.

LAC ESG International Bond Issuance by Type of Instruments

(US$ Million)

Source: authors’ elaboration based on data compiled by ECLAC from market sources, including Dealogic, LatinFinance and Bloomberg.

There are two types of structure in the sustainability debt market: green, social and sustainability bonds are ‘Use of Proceeds’ bonds, associated to a specific environmental, social (or a combination of social and environmental) project; the sustainability-linked bonds (SLB) are target-linked, with issuers selecting key performance indicators (KPI) and associated sustainability targets they want to achieve. If the target is not met, a step-up mechanism will be applied to the bond’s interest rates. The SLBs are thus more closely aligned to the issuer’s overall sustainability strategy, and are not linked to a specific project.

The document “Corporate Governance in Latin America and the Caribbean: using ESG debt instruments to finance sustainable investment projects” reviews recent developments in the corporate bond market for sustainability-linked bonds, and the role of corporate governance in companies’ reporting based on ESG criteria. It examines the potential of these debt instruments as a source of financing for investment projects, as well as their role in strengthening the governance structures of companies and contributing to a sustainable recovery in the region, taking into consideration the commitments to reduce climate risks (Paris Agreement 2015 and COP 26), and fulfil the Sustainable Development Goals (SDGs) and the 2030 Agenda.

The report studies the sustainability frameworks and SLB issuances in the international fixed-income market of six Latin American companies (Suzano, Klabin, CMPC, FEMSA, JBS and Nemak). The companies were selected from the region’s top three SLB issuers – Brazil (60%), Mexico (28%) and Chile (8%) – and the top three sectors – transportation (26%), forestry and paper (23%) and food and beverage (22%).

The analysis shows that KPI information, so far, is not benchmarkable. Companies may select the same KPI as industry peers, but their metrics differ widely. Due to the lack of harmonized metrics, companies can mitigate comparability by tailoring KPIs to the scope of their operations or business models. More importantly, for many of the KPIs chosen, no international target has yet been established.

The absence of a clear agreed framework for reporting, measuring, and comparing the climate impact of corporate activity, as well as of benchmarks, may be an impediment to scaling-up ESG strategies in the region’s business sector. Despite increasing board involvement in the decision-making process related to climate risk, and improvements in the quality of information captured by the market, it is still hard to use the information provided by companies’ ESG reports to make direct comparisons between investments. Although in most cases data is quantified, the information may not be comparable across periods or sectors, and even within sectors, making it difficult to measure and compare the overall impact of corporate efforts and production activity on promoting a sustainable transition.

This document is a joint effort between the Production, Productivity and Management Division and the ECLAC Office in Washington D.C.

Related content

Subregional headquarter(s) and office(s)

National Office, Washington, D.C.Type

Country(ies)

- Latin America

Related link(s)

Contact

ECLAC Office in Washington

- eclacwash@eclac.org