Latin America and the Caribbean must support foreign investments that help close the productive and social gaps in the region

Work area(s)

Topic(s)

Teaser

Cross-border mergers and acquisitions played a large role in global FDI, especially in developed economies, driven by greater international liquidity and industry strategies that led to major operations. Meanwhile, China was the second biggest provider of global FDI, after the United States, as its foreign investments increased steadily, particularly acquisitions in the European Union and the United States. China’s “Go Global” strategy, launched more than a decade ago, has consolidated its role as a global player that is integrating into the workings of increasingly sophisticated sectors, by actively engaging with new technological trends of the fourth industrial revolution.

Key Messages

|

FDI fell by 7.8% in Latin America and the Caribbean in 2016

FDI flows into Latin America and the Caribbean declined by 7.8% to US$ 167.180 billion in 2016. This outcome derived from weaker investment in natural resources, particularly metal mining, and slow economic growth in the region. Performances were mixed from one country to the next and FDI fluctuated considerably year-on-year.

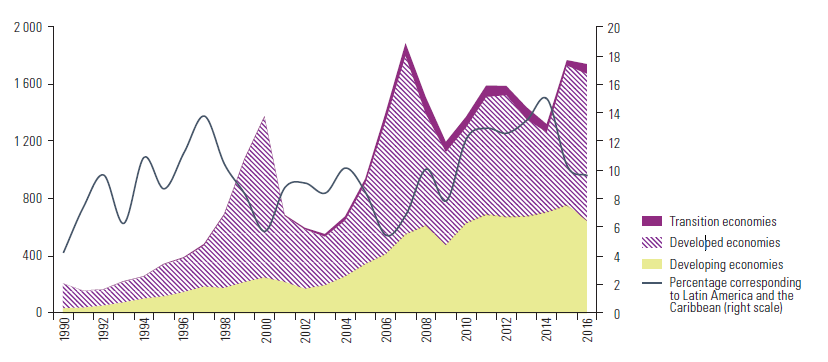

Global FDI flows by groups of economies, and proportion corresponding to Latin America and the Caribbean, 1990-2016 (Billions of dollars and percentages)

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures and United Nations Conference on Trade and Development (UNCTAD), World Investment Report, 2017: Investment and the Digital Economy (UNCTAD/WIR/2017), Geneva.

At the subregional level, FDI in South America fell by 9.3%, while flows into Central America and the Caribbean rose by 4.9% and 3.3%, respectively Within South America, Colombia posted the biggest increase in inflows (15.9%) and investment in Brazil climbed 5.7%. The largest declines in FDI were seen in Argentina (64.0%), Ecuador (43.7%) and Chile (40.3%). Investment in Mexico dropped by 7.9%, although it emained high compared with the levels seen in the ast decade. Central America received a larger share f FDI, umping from 3.7% of the total in 2010 to 7.2% n 2016. In this subregion, investment in Panama was at an all-time high, up 15.9% to US$ 5.209 billion. In the Caribbean, inflows to the Dominican Republic grew by 9.2%, totalling US$ 2.407 billion.

It is important for the countries of the region to review and improve their FDI attraction strategies to direct them more towards economic upgrading and productive diversification.

Decreasing FDI profitability is damaging investment prospects

Despite a 12.8% rise in FDI stock in 2016 –to a record high– the average profitability of foreign capital stock fell again, reaching its lowest level in the last 15 years (4.2%). Around 55% of this income was repatriated to the countries of origin, meaning that there was a relative increase in reinvested earnings compared with repatriated earnings, which were as high as 70% in 2013.

Although the decline in average return on assets has primarily been the result of the plummeting prices of mining products, almost all sectors of the economy have experienced a downturn. A comparison of the average for the period 2011-2014 with 2015 shows that the mining and oil and gas sectors were dealt the heaviest blow, and that the telecommunications sector also saw a significant decline.

https://www.cepal.org/sites/default/files/grafico_2_en_enfoques.png?tim…" />

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of preliminary figures and official estimates at 15 June 2017.

Note: The subregional total for the Caribbean excludes Trinidad and Tobago in 2016, since the respective information was not available. The data for Bolivarian Republic of Venezuela refer to the first three quarters of 2015.

Sectors geared more towards the domestic market (for example beverages) or that have natural advantages strengthened by innovation processes (such as food and agribusiness) have seen relatively stable rates of return, at least in the case of large companies. The pattern is similar in service activities such as retail or electric power, which, despite a slight fall, continue to maintain above-average rates of return.

Latin America and the Caribbean:a stock and average profitability of FDI, 2000-2016a (Trillions of dollars and percentages)

https://www.cepal.org/sites/default/files/grafico_3_en_enfoques.png?tim…" />

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of official figures and estimates as of 15 June 2017.

Note: Average profitability is measured as FDI income divided by FDI stock.

a Does not include data for the Bolivarian Republic of Venezuela, Jamaica, Trinidad and Tobago or the member countries of the Organisation of Eastern Caribbean States (OECS).

Rising star: non-conventional energy

Renewable energy project announcements have increased steadily over the past decade. This sector attracted the most greenfield investment in 2016, with its share of the total climbing from an average of 6% for 2005-2010 to 18% in 2016, making it the fastest-growing sector in that period.

Through tenders and auctions conducted in many countries, this sector has become firmly established in the energy matrix: for example, in Honduras, 9.8% of the electricity supply comes from solar photovoltaic energy and in Uruguay, 22.8% of the electricity consumed in 2016 came from wind power. Many of these developments are the result of investment by transnational corporations, led by Spanish firms including Abengoa, Iberdrola and Acciona; the Italian company, Enel; Ireland’s Mainstream Renewable Power; France’s Engie; and firms from the United States and Canada.

The benefits of FDI depend on the characteristics of the production systems of recipient countries

Countries’ ability to take ownership of FDI benefits is closely linked to factors such as the workforce’s level of education, the competitiveness of local industry and its ability to develop links as suppliers to foreign companies, or the existence of a cluster of related businesses.

The production and entrepreneurial context of the region —with its large productivity gaps among economic sectors and actors— means that policies that build local capacities must be implemented. These policies, together with FDI inflows, will help to create more dynamic production systems capable of producing higher value-added goods.

Latin America and the Caribbean: Return on assets by sector (Percentages)

https://www.cepal.org/sites/default/files/grafico_4_en_enfoques.png?tim…" />

Source: Economic Commission for Latin America and the Caribbean (ECLAC), on the basis of data from América Economía.

Note: The data show results for the 500 biggest firms, by annual turnover, in Latin America and the Caribbean, excluding those firms that do not publish specific data on their subsidiaries abroad. The data cover cross-border and national firms, but not State-owned firms. The sectors included in figure are the eight sectors with the highest turnover, according to América Economía (2015). The average sectoral return on assets is calculated as the ratio between profits and assets.

Rethink strategies to attract FDISouth American economies, specialized in the production of commodities, in particular oil and minerals, and with strong commercial ties to China, will be affected by the global economic situation, as well as their very low growth rates (ECLAC expects 0.6% growth for 2017). While the growth forecasts for Central America and Mexico are more favourable, at 3.6% and 2.2%, respectively, the uncertainty surrounding the NAFTA renegotiation may affect the flow of investment to those countries. Taking all of that into account, ECLAC expects FDI inflows to the region to fall again by up to 5% in 2017. In this scenario, foreign investments that help to narrow the region’s production and social gaps are increasingly important. FDI can be a key factor in technology transfer and the adoption of new management systems and business models that increase competitiveness and productivity. It can also play an important role in the development of road, port, and energy and telecommunications infrastructure, especially in the context of fiscal spaces that are narrower than they were during the most recent commodity price boom. |