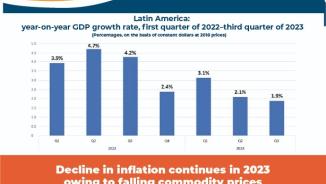

infographic

A new study by the Economic Commission for Latin America and the Caribbean (ECLAC), entitled A regional reserve fund for Latin America, analyzes the viability of expanding the Latin American Reserve Fund (FLAR) to five more of the region's countries: Argentina, Brazil, Chile, Mexico and Paraguay.

In September, however, Paraguay was incorporated into the FLAR, whose other members include Bolivia, Colombia, Costa Rica, Ecuador, Peru, Uruguay and Venezuela.

Founded in 1978, the FLAR is the only regional fund of Latin American reserves and it was formed as an organization in which members make capital contributions to help each other during balance of payment or currency crises, which are understood as the problems countries may have to face to defend their exchange rates.

This kind of fund also provides countercyclical financing to manage external shocks, meaning that its expansion could foster greater financial stability in Latin America. However, the report explains, it is not conceived as the only defense, but rather as an additional line of protection to support the existing balance of payments.

Therefore, the document adds, the FLAR must not position itself as a lender of last resort, because within the bigger structure of the global financial architecture, member states-particularly bigger ones-can turn to other entities to cover liquidity needs if they face balance of payment problems.

According to the report, an expanded FLAR could be of special help to countries with less access to other financing sources, and it would have the capacity to address balance of payment problems in several countries simultaneously.

For example, in a scenario in which capital contributions from new countries followed the FLAR's present logic, the expanded fund would grow to nearly 9 billion dollars, equivalent to 1.4 % of these countries' total international reserves base.

This would enable the fund to simultaneously cover potential demands from all small countries and half the needs of medium-sized countries, calculated to total some 7.80 billion dollars.

In a more extreme and widespread scenario, the expanded FLAR should adopt strategies to obtain additional resources, either by leveraging its capital or teaming up with other financial actors.

If the fund leveraged its capital via medium- and long-term debt for 65 % of the paid capital-which is the maximum authorized by the FLAR-this would generate lending resources of nearly 13.30 billion dollars.

With this, the expanded FLAR could cover simultaneously more than 85 % of the potential needs of all its member states, with the exception of the two biggest ones. Those possible necessities were estimated at 15.30 billion dollars.

Beyond the feasibility of expanding the FLAR, the study warns that the incorporation of new members would imply big challenges for its governance, in terms of voting and decision-making mechanisms, the criteria for granting credit, and mechanisms for supervision.