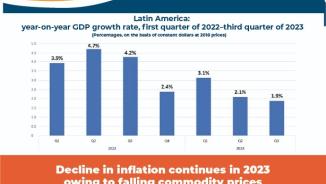

infographic

Thirty years after the debt crisis erupted in 1982, Latin America and the Caribbean has higher-quality and cheaper access to the international bond market, which is the second-biggest source of external financing after foreign direct investment (FDI), according to a new study by the Economic Commission for Latin America and the Caribbean (ECLAC).

The document, entitled Debt financing rollercoaster: Latin American and Caribbean access to international bond markets since the debt crisis, 1982-2012, shows that during the biennium of 2010-2011, bond flows toward Latin America and the Caribbean averaged 78.96 billion dollars, which represents a sharp increase from the annual averages of 15.05 billion and 15.73 billion dollars in 1990-1999 and 2000-2009, respectively.

As the title of the document implies, this 30-year period has been characterized by ups and downs in which moments of optimism and crisis alternated.

The study compares the present situation with the beginning of the 1980s, when after three decades of growth, Latin American countries faced a serious crisis stemming from the rapid increase in debt with creditor banks in the 1970s and from the deterioration of the global economic scenario.

The international recession reduced export markets and drove down the prices for basic products, while restrictive monetary policies in industrialized countries forced interest rates upward worldwide and increased the real burden of Latin America's inflated debt.

Starting in 1982, the proportion of commercial bank loans dropped drastically while official credit from bilateral and multilateral sources increased significantly, but this was not enough to avert a crisis and net capital outflows were so high that the region's growth was seriously hindered, the report explains.

As far back as 1983, commercial banks began developing a small secondary market to trade sovereign loans, which gained greater momentum in 1986 and 1987, when creditors were allowed to swap sovereign debt for stock in public companies or in other endeavors, or for local assets.

In the 1990s, the increased growth potential and high yields in most countries of the region, along with a move to implement economic and political reforms, attracted more and more investors. But bond flows toward Latin America-on which its growth depended, to a large extent-tended to be highly volatile.

As a result, a wave of financial crises swept through the region, starting with the devaluation of the Mexican peso in 1994 and ending with Argentina's debt default in 2001.

This crisis led to the real depreciation of the region's foreign exchange rates, which served to stimulate exports and which, along with a favorable international context, translated into sizeable current account surpluses. Coupled with more prudent fiscal management, those surpluses allowed Latin American countries to reduce their levels of foreign debt and thus decrease their vulnerability.

According to the document, between 2005 and 2010 the solid performance of Latin America's capital markets, along with an abundance of liquidity in global markets, enabled a considerable reduction of risk margins compared with the previous decade.

In addition, debt was issued in a broader spectrum of currencies; the quality of credit had improved substantially and Latin American and Caribbean external debt attracted a bigger and more diversified base of investors.

But the report emphasizes that despite the achievements seen during this period, access to external debt financing is not universal, the vulnerability to external shocks is still a threat, and the necessary changes to the region's production structure have not occurred.

Those structural changes should be at the heart of a long-term growth process to make equality a reality, and getting broader and cheaper access to international markets may be essential to clearing that path, the study concludes.