Comunicado de prensa

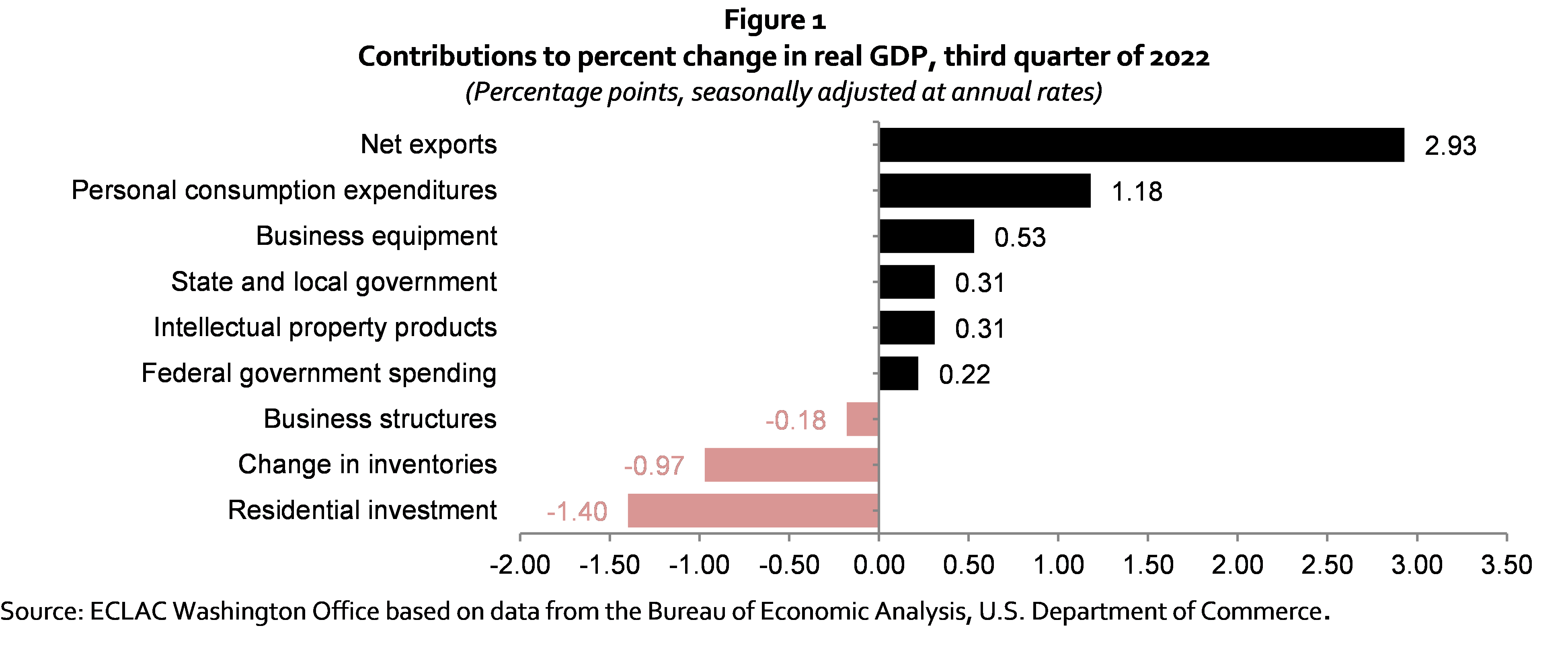

1. The United States Gross Domestic Product (GDP) rose 2.9% in the third quarter of 2022, reversing the declines in the previous two quarters. Trade was a major support, adding 2.9% to third quarter growth, with consumer spending, business investment and government spending also making positive contributions. Inventories and housing investment made negative contributions, subtracting 1.0% and 1.4%, respectively, from growth in the quarter (figure 1).

2. The labor market averaged 392,000 new jobs per month from January to November 2022 with 4.3 million new jobs being created in the period, after 6.7 million jobs were created in 2021. At the end of November, the U.S. labor market was a net 1 million jobs above its pre-pandemic level (figure 2).

3. Inflation rose 7.1% in November, the slowest 12-month pace since December 2021, closing out a year in which inflation hit the highest level in four decades. The November inflation number builds on a trend of moderating price increases that started after a peak of 9.1% was reached in June (figure 3). Core inflation rose 6.0% in November, easing from a 6.3% gain in October. The rapid pace of price increases in 2022 added pressure on the Federal Reserve to raise rates aggressively to tame inflation.

4. The pace of monetary policy tightening this year has been the fastest since the early 1980s: in just 10 months the federal funds rate has risen 4.25 percentage points (figure 4). At the end of the last policy meeting concluded on 14 December 2022, the federal funds rate was raised by a smaller 0.50% (instead of 0.75%), suggesting a slower pace of tightening going forward.

5. Inflation concerns, the United States Federal Reserve’s tightening monetary policy stance and the strength of the dollar contributed to push funding costs higher in Latin America and the Caribbean (LAC). Against the backdrop of higher global interest rates and borrowing costs, LAC issuers placed US$ 58.5 billion worth of bonds in international bond markets from January to October of 2022, down 58% from the same period in 2021 and with an average coupon that was almost 1.5% higher (figure 5).