Anuncio

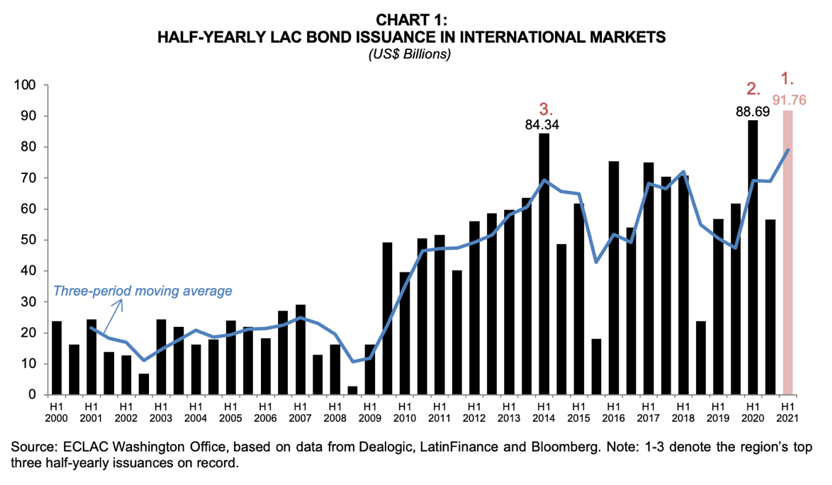

1. Against the backdrop of low global interest rates and borrowing costs, LAC issuers placed US$ 91.8 billion worth of bonds in international bond markets in the first half of 2021, reaching a new half-yearly peak (chart 1). The third quarter amount was US$ 32.6 billion. From January to September, the total LAC issuance reached US$ 124.3 billion.

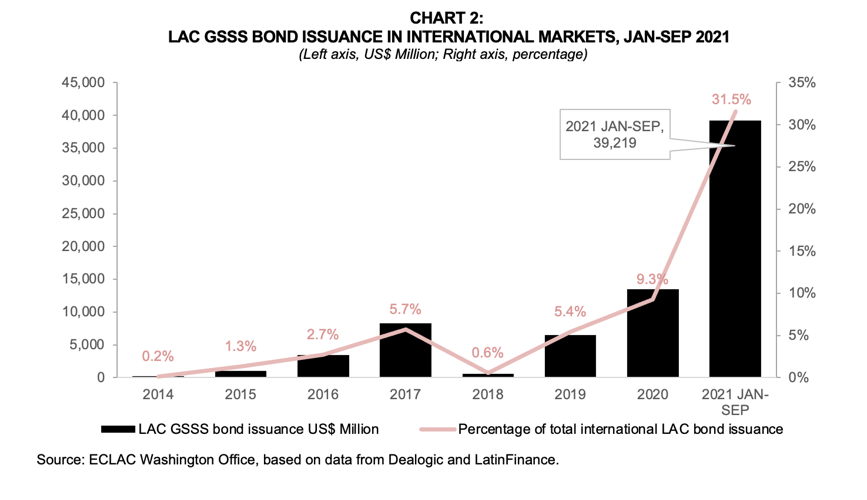

2. Of the January-September total, almost US$ 40 billion (31.5%) was issued with the purpose of financing ESG projects and strategies through the issuance of green, social, sustainability and sustainability-linked (GSSS) bonds. This share was more than three times the 2020 share of 9.3% and almost eight times the 4.2% average of the 2015-2020 period.

3. Sustainability-linked bonds (SLB), which are forward-looking performance-based instruments, were the region’s most frequently used ESG instrument, accounting for 37% of the total GSSS issuance in the first nine months of 2021.

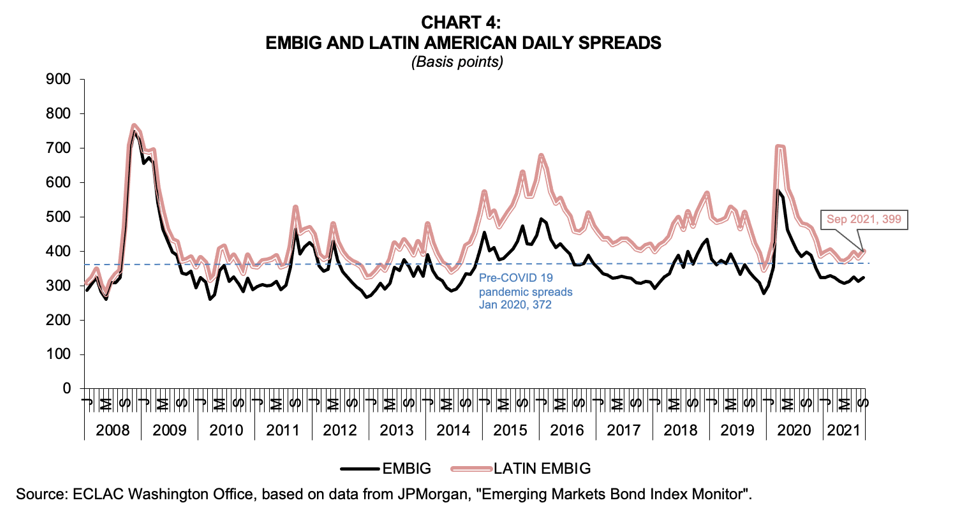

4. At 399 basis points, LAC bond spreads at the end of September, as measured by the JPMorgan Emerging Market Bond Index Global (EMBIG) Latin component, were 27 basis points higher than pre-pandemic levels. LAC bond spreads widened 13 basis points in the first nine months of the year.

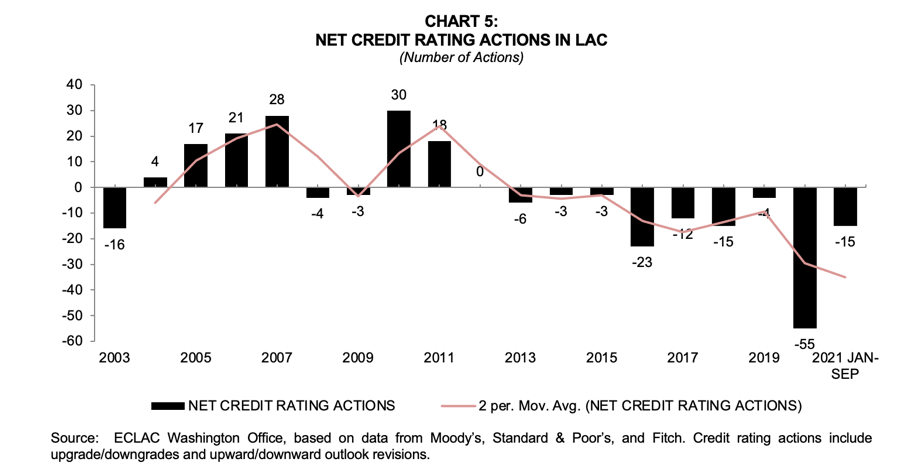

5. Credit quality in the region deteriorated in the first nine months of 2021. There were fifteen more negative credit rating actions than positive in the period, including eleven downgrades and no upgrades. Negative credit rating actions have outnumbered positive actions in the region for eight years in a row (nine if the balance remains negative at the end of 2021).

For a complete and detailed analysis see the PDF attachment with the full document.