Capital Flows to Latin America and the Caribbean in five charts: 2022 year-in-review and early 2023 developments

Work area(s)

Topic(s)

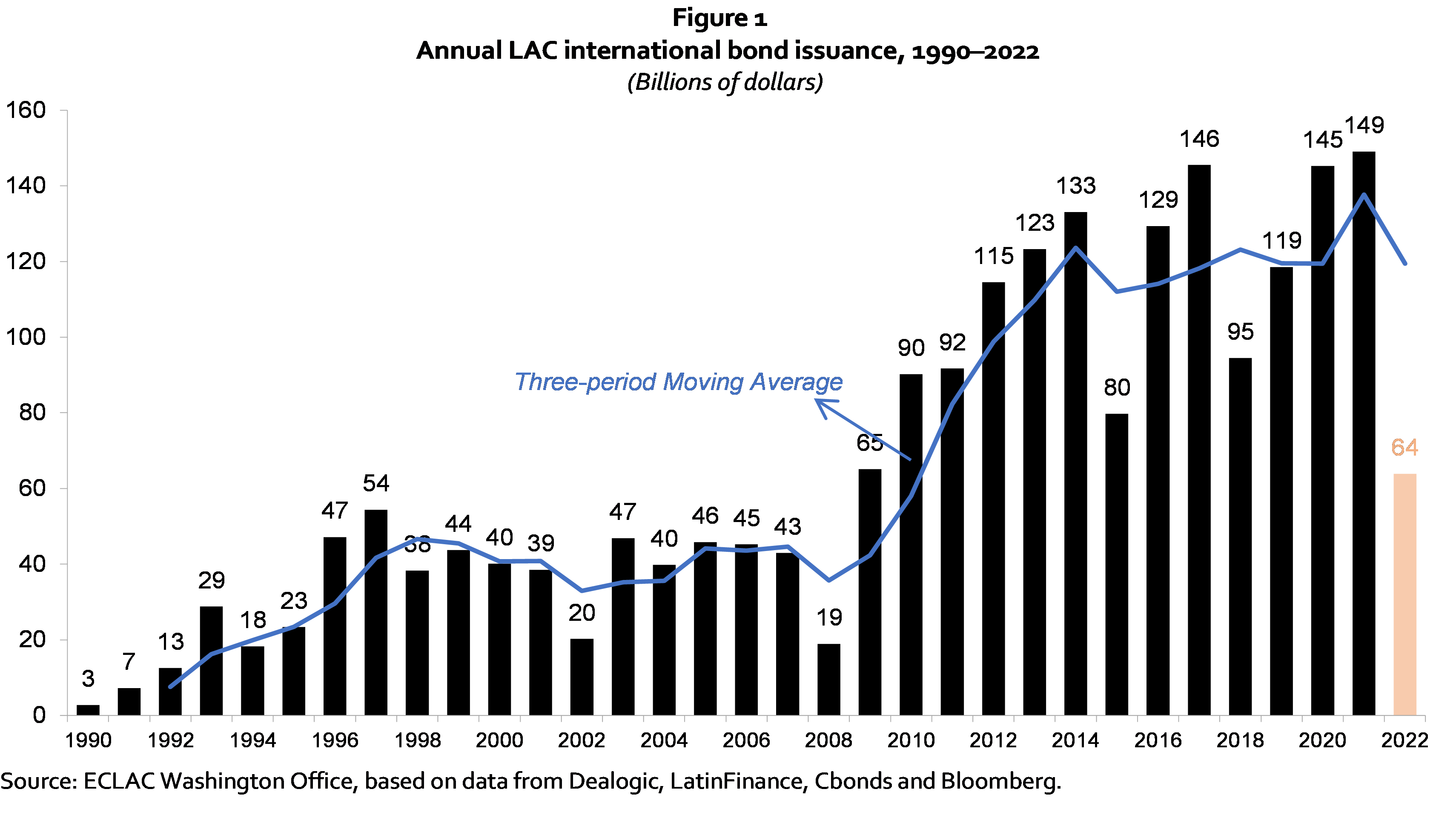

In 2022, Latin American and Caribbean bond issuers placed the lowest annual amount of international debt since 2008.

1. Against the backdrop of higher global interest rates and borrowing costs, total Latin American and Caribbean (LAC) international bond issuance was US$ 64 billion in 2022, with an average coupon that was 1.3% higher and an average maturity that was three years lower than in 2021. This was the smallest amount of international bonds placed by the region’s issuers since 2008 (figure 1).

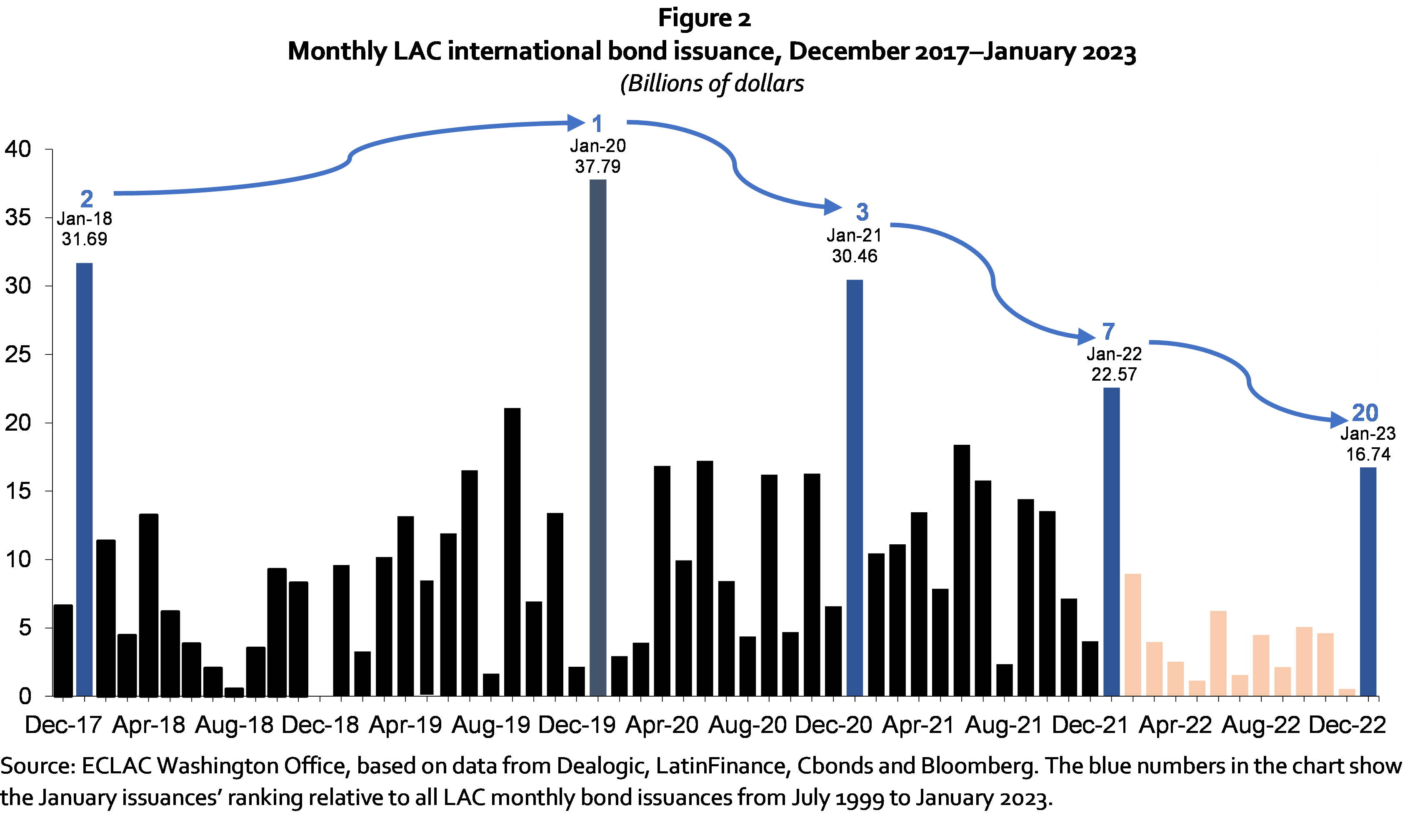

2. January has historically experienced a high volume of bond issuances and January 2023 was no exception, although it was not as busy as in previous years. LAC bond issuance in January 2023 increased to US$ 16.7 billion from only US$ 550 million in December 2022, on the expectation that a period of rising global interest rates may be nearing its peak and in anticipation of China’s economic reopening (figure 2).

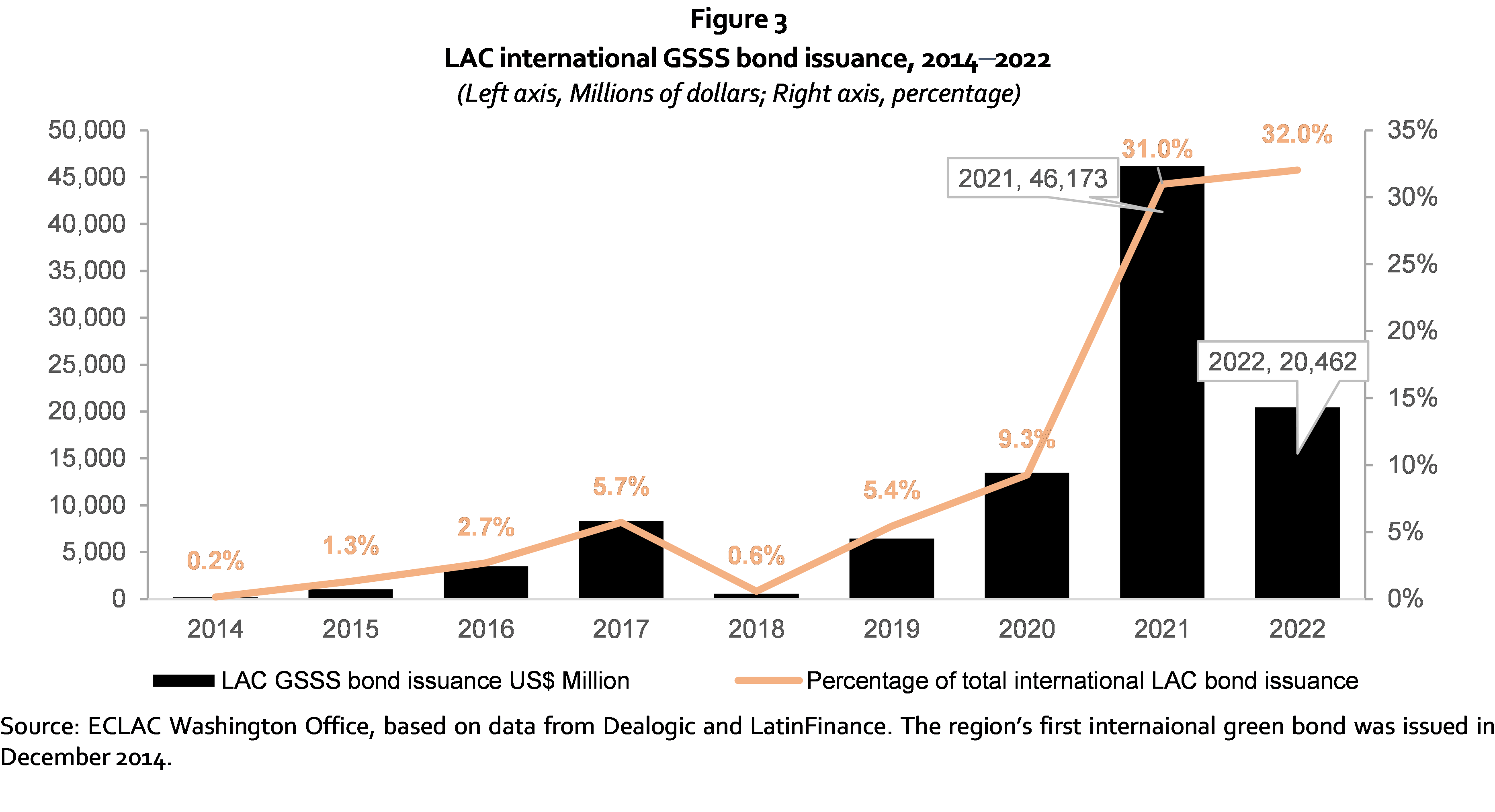

3. Following the broader market trend of declining bond activity due to worsening macroeconomic conditions, the region’s sustainable bond issuances also declined in 2022. The region issued US$ 20.5 billion of international green, social, sustainability and sustainability-linked (GSSS) bonds in 2022, down 56% from 2021, but still the second highest GSSS annual volume ever issued in international markets (figure 3).

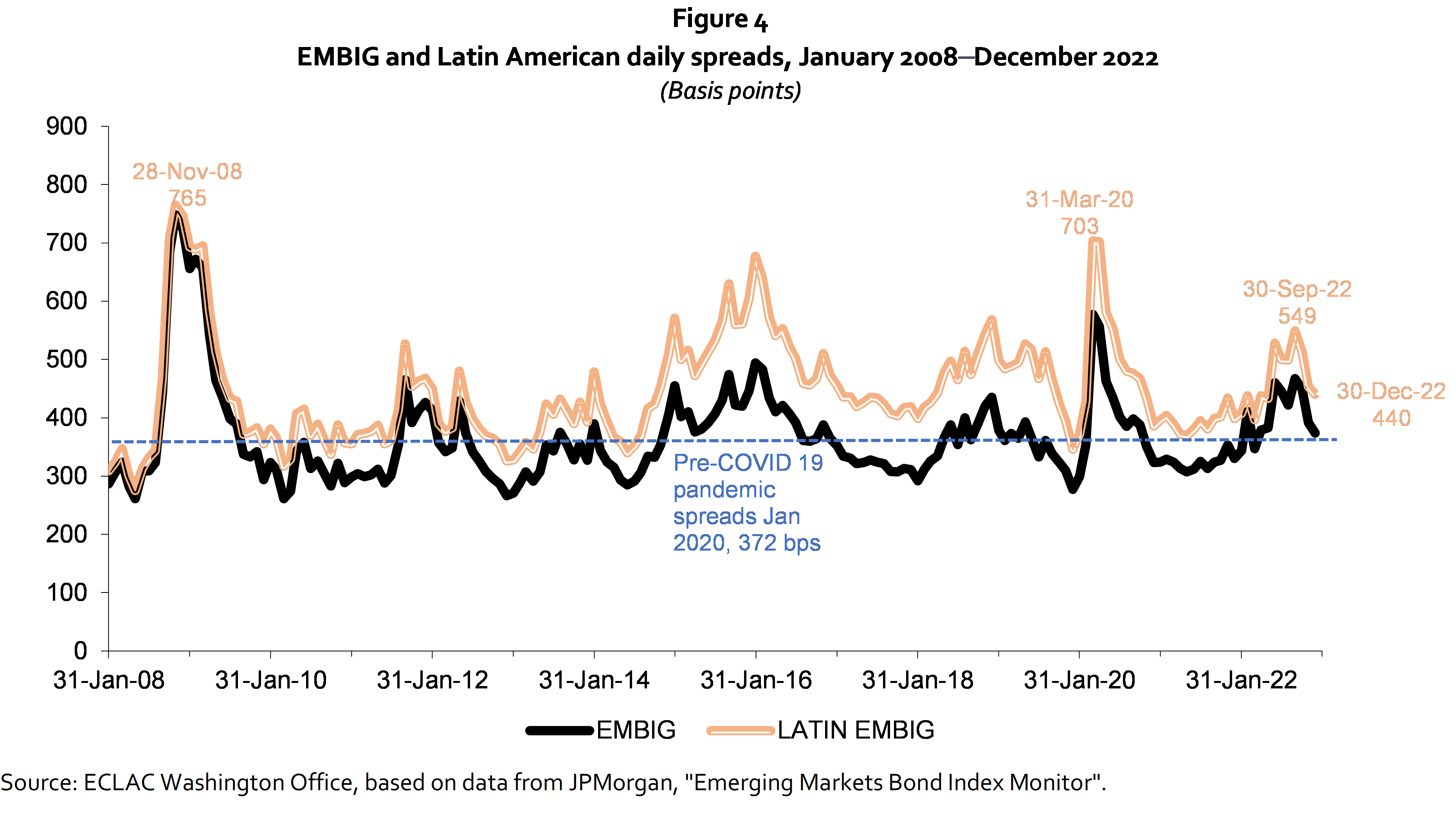

4. Borrowing costs for LAC issuers increased by 41 basis points in 2022, amid rising financing costs and weaker risk sentiment, and reached a peak for the year in September 2022. At 440 basis points at the end of December, LAC bond spreads were 68 basis points higher than pre-pandemic levels (figure 4).

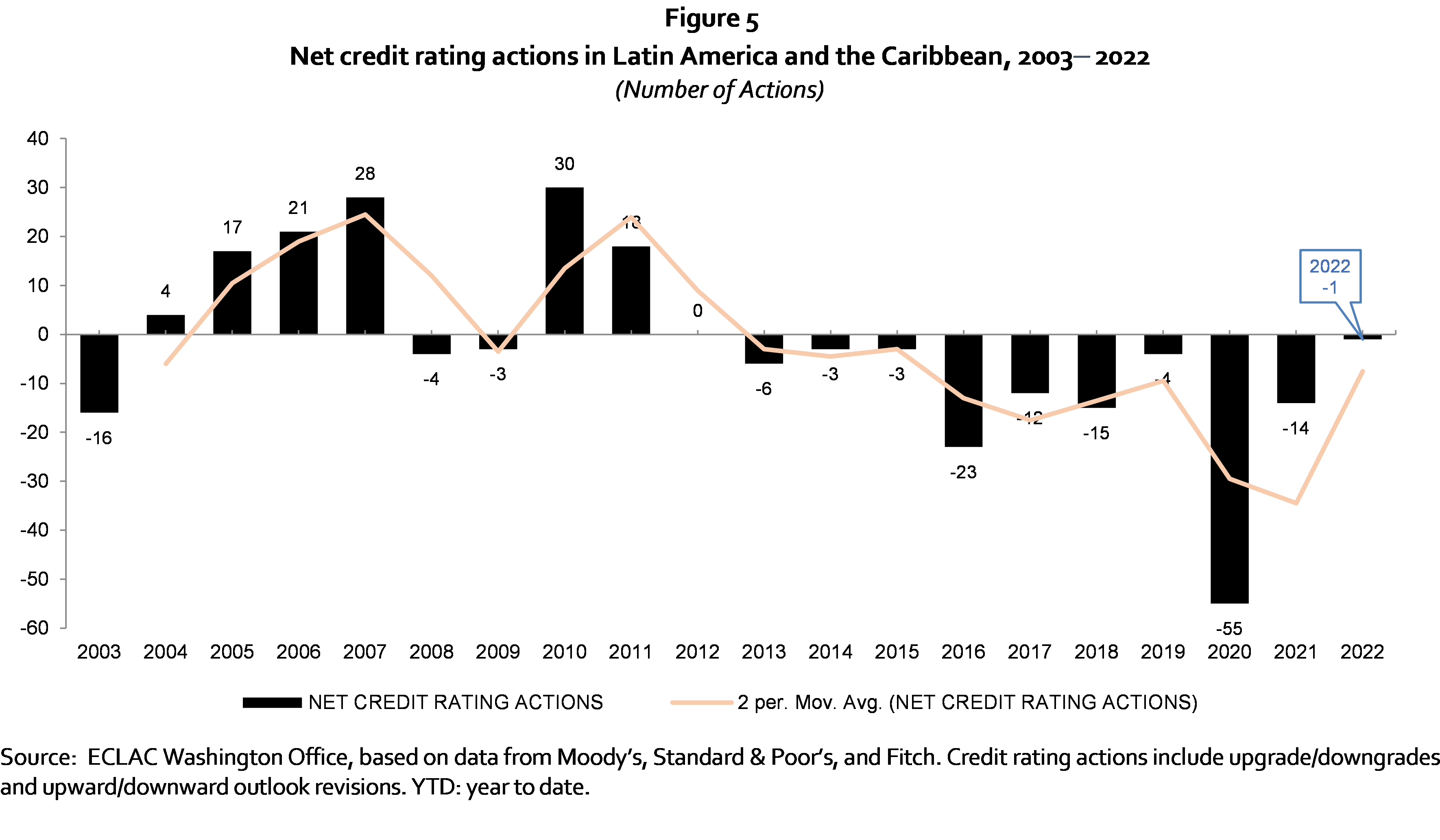

5. Supported by fading pandemic-related pressures, lower funding needs and greater reliance on local markets, the region’s credit outlook trended upwards in the first half of the year, but amid constrained funding options and higher external borrowing costs it trended downwards in the second half. As of end-December 2022, the balance for the year was one more negative credit rating action than positive, the best annual balance since 2012 (figure 5).

For a complete and detailed analysis see the PDF attachment with the full document.

Subregional headquarter(s) and office(s)

National Office, Washington, D.C.Country(ies)

- United States