video

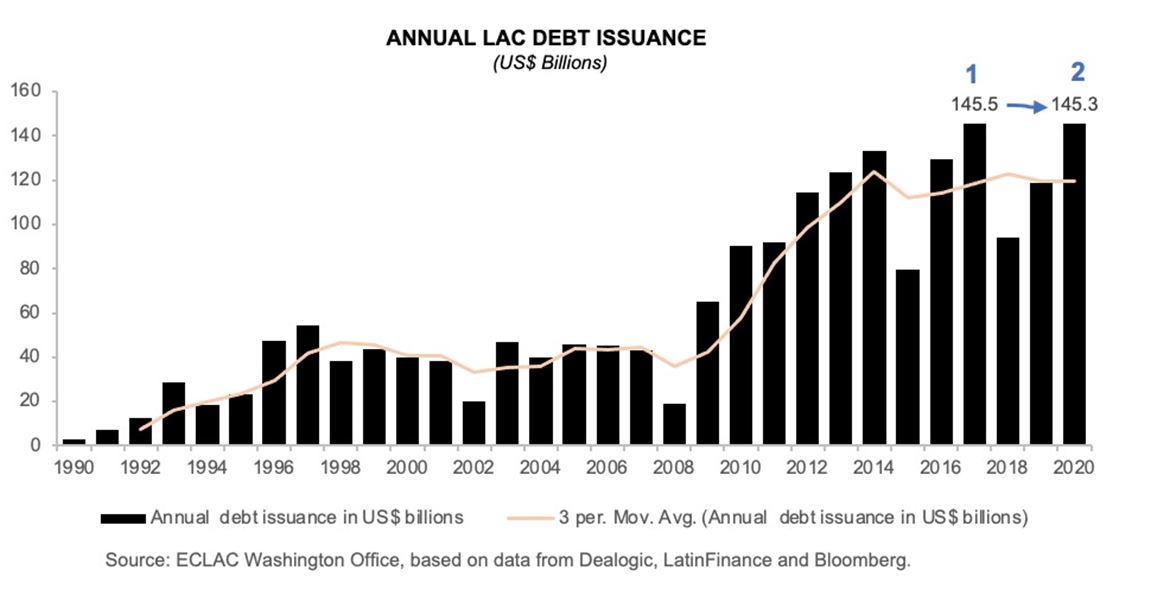

Latin American and Caribbean (LAC) bond issuances in the international market reached their second highest level on record in 2020, while coupons came down and maturity increased from 2019 levels.

1.- In 2020, total LAC bond issuance in international markets reached US$ 145.3 billion, the second highest annual issuance on record. The 2020 total was 23% higher than in 2019 and second only to the historic record of US$ 145.5 billion reached in 2017

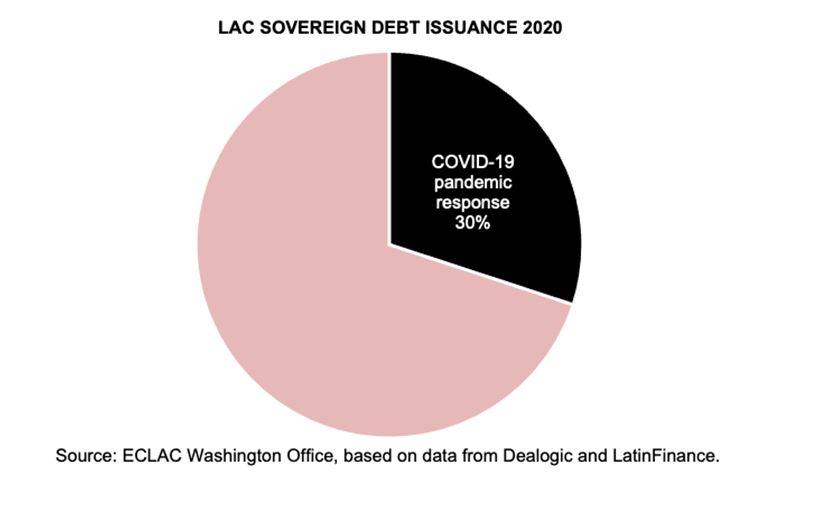

2.- Sovereign issuance, in terms of amount, was the highest on record, as governments – with a backdrop of low global interest rates and borrowing costs – sought to meet higher funding needs due to the pandemic. LAC sovereign issuance reached US$ 65 billion in 2020, 54% higher than the total sovereign issuance in 2019. About 30% of this total (US$ 19.6 billion) explicitly mentioned that the proceeds would be used to fund the response to the COVID-19 pandemic.

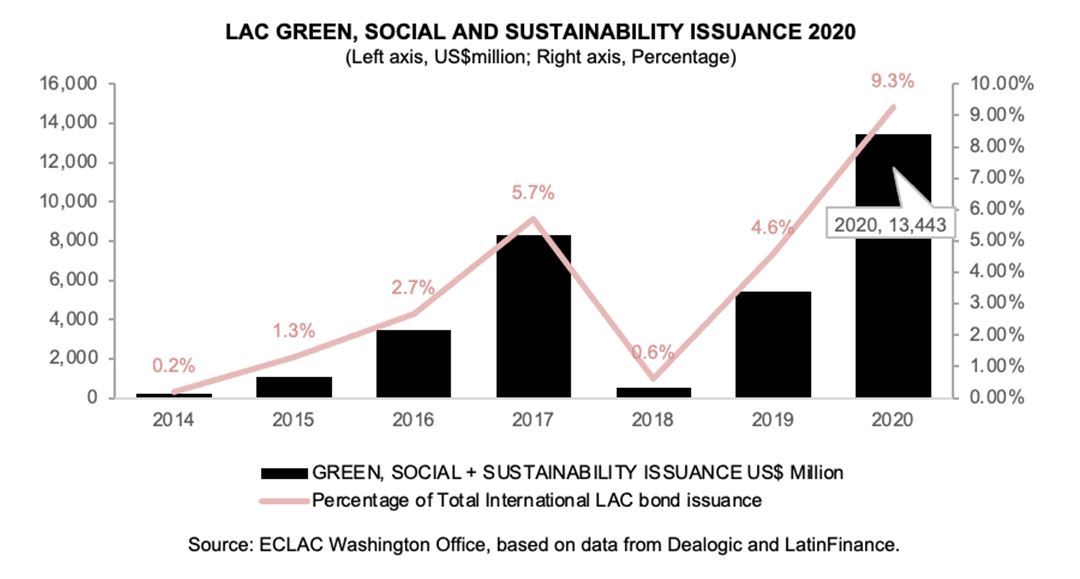

3.- Green, social and sustainability bond issuance represented a record 9.3% of the total amount issued in 2020 (US$ 13.4 billion).

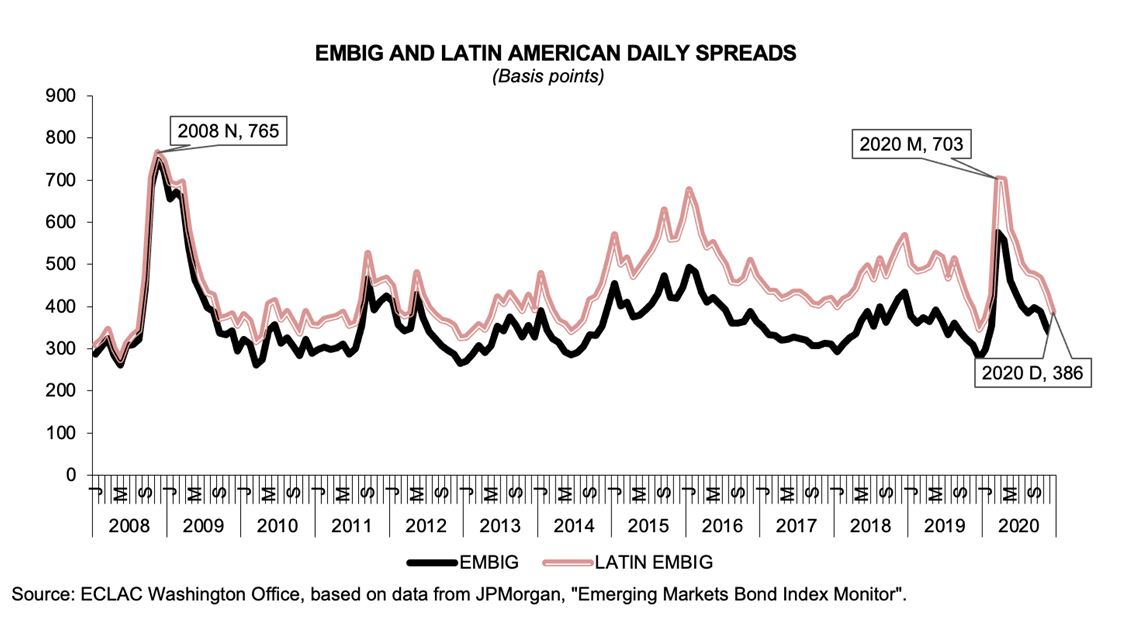

4.- LAC spreads widened 40 basis points in 2020. After widening 357 basis points in the first quarter, they narrowed in the following three quarters, as volatility and risk aversion came down after reaching a historic peak in mid-March. They were at 386 basis points at the end of December.

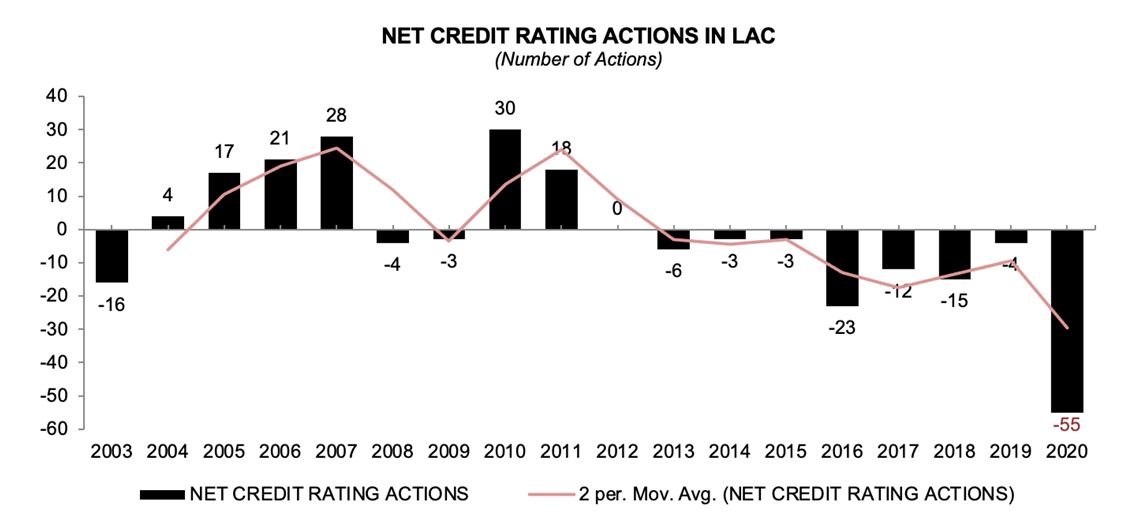

5.- Finally, credit quality deteriorated sharply in 2020. Negative credit rating actions (including downgrades and downward outlook revisions) have now outnumbered positive actions in the region for eight years in a row. The imbalance was much worse in 2020, with an unprecedented 55 more negative actions than positive, and 36 more downgrades than upgrades.

For a complete and detailed analysis see the PDF attachment with the full document