14 Dic 2023

Comunicado de prensa

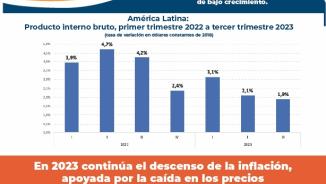

La actividad económica de América Latina y el Caribe continúa exhibiendo una trayectoria de bajo crecimiento: CEPAL

La actividad económica de América Latina y el Caribe continúa exhibiendo una trayectoria de bajo crecimiento: CEPAL